The Complete List of New Cars, Trucks & SUVs That Qualify for the US Federal Electric Vehicle Tax Credit in 2023

As the world continues to focus on reducing carbon emissions and combating climate change, electric vehicles (EVs) are becoming an increasingly popular choice for drivers. In the United States, the federal government offers tax credits to incentivize the purchase of EVs and plug-in hybrid electric vehicles (PHEVs) to make them more affordable for consumers. Under the Inflation Reduction Act (IRA) individuals who qualify can get a tax credit up to $7,500 for buying or leasing a new EV or plug-in hybrid vehicle. There is also a tax credit of up to $4,000 available for the purchase of used vehicles. The list of vehicles that qualify for the used EV tax credit is more expansive but who qualifies (based on income and other criteria), is more restricted. Consequently, we will cover the complete list of qualifying used electric vehicle options in another post.

For those looking to buy a new all electric or plug-in hybrid vehicle, the good news is that the list of vehicles you can get a federal tax credit for was recently expanded. Under the IRS regulations, different types of vehicles have different MSRP caps with larger vehicles (SUVs and trucks) using the $80,000 MSRP maximum and passenger cars generally falling under the $55,000 MSRP cap. Even though the caps tend to correspond to a vehicle’s size, sometimes the MSRP caps are not intuitive (e.g. a new Tesla Model Y has an $80,000 MSRP cap while the Model 3 cap is $55,000). We have grouped the qualifying vehicles by their respective caps below to make it easier to “see at glance” which vehicle falls into which category.

What is the difference between MSRP and sale price for an electric vehicle?

MSRP is different from sale price. MSRP is the manufacturer's suggested retail price, which is the price that the manufacturer recommends dealerships sell the vehicle for. The sale price, by contrast, is the actual price that a dealership sells the car, truck or SUV for, which may be higher or lower than the MSRP due to added features, discounts, negotiations, and other factors.

Another important note about the complete lists of new vehicles qualifying for federal tax credits in 2023 shown here is that we compiled these collections on Feb 21st, 2023. Why does that matter? Many highly anticipated EVs expected to come out in 2023, like the Chevrolet Blazer EV, will likely qualify for the federal tax credit. However, these are not officially on the IRS’s current approved vehicle list yet, and so we have not included them here either. The IRS approved vehicle list is grouped by manufacturer and is updated regularly. If you want to check the tax credit eligibility status of a new car, truck, or SUV in real time, we encourage you to look on their website using the link above to access the most current information.

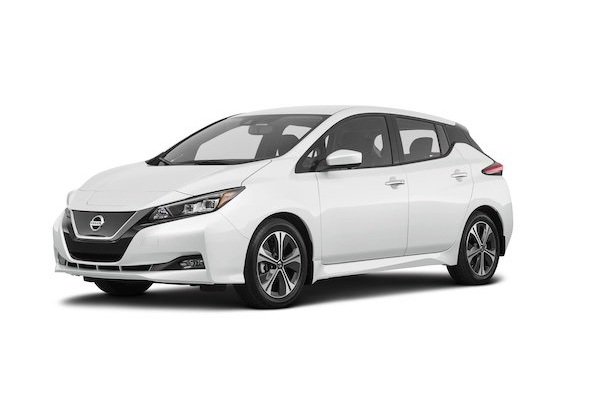

Here you will find the complete list of hybrid plug-in and all electric vehicles approved for federal tax credits as of February 2023 - conveniently grouped by their type and current MSRP caps. Click on the image to learn more abut the vehicle you like best!

New Plug-In Hybrid Vehicles with a MSRP Limit of $80,000

New Plug-In Hybrid Vehicles with a MSRP Limit of $55,000

New All Electric Vehicles with a MSRP Limit of $80,000

New All Electric Vehicles with a MSRP Limit of $55,000

Interested in buying one of the eco-friendly electric vehicle options above? Don’t forget to check whether you qualify for the EV tax credit in advance to make sure you are eligible for the generous federal tax credits being offered this year so you won’t be disappointed when it comes time to file.